Raise capital smarter with AI assistance and the right advisors.

In 2025, Iceberg supported more than $24 million in fundraising, driven by a 8,000+ live global investor database and an average 15-30% positive response rates from AI-recommended outreach, and input from experienced advisors within our network.

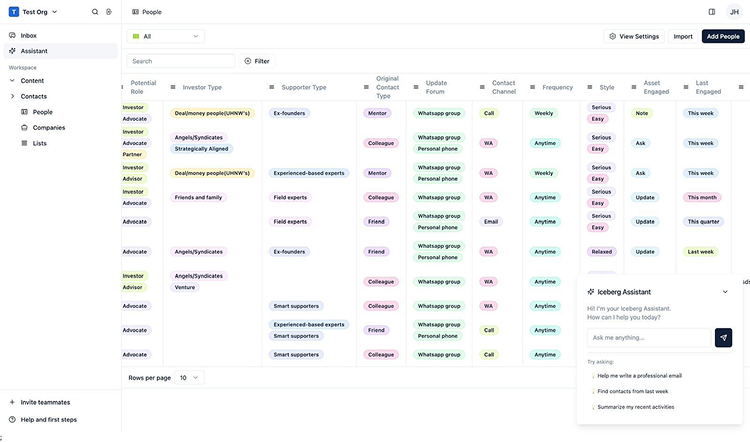

Get pitch deck feedback, find and prioritise the right investors, draft personalised outreach, track live engagement, and manage everything in one AI native system.

When you need it, layer in advisors with relevant networks and deal experience to help drive momentum and close faster.

How much is unplanned investor outreach and communication costing you?

On average founders and advisors spend significant time on unplanned investor outreach and communications using disparate tools, resulting in low investor engagement.

In just the last year, founders have raised $24m+ using our system

With Iceberg’s nurturing system founders are saving time and creating opportunities

founders: Order investor contacts

“If you already know what you’re raising – or you’re running a live advisory mandate – you can order investor contacts directly.”

This is already being used by:

- 700+ founders planning a raise this year

- 3 accelerators supporting multiple cohorts

- 3 funds reaching out to LPs

- 5 advisers lining up warm introductions or future mandates

- Contact + feedback tracking

- Monthly investor news updates

- Quarterly database updates

- Delivered directly into the assistant

- Ongoing engagement support

Founders: get ai-Fundraising Assistance

‘Help me Fundraise more efficiently and effectively’

Get pitch deck feedback, find the right investors, draft personalised outreach, track live insights, and manage everything in one AI-native CRM.

(10 Investor contacts included)

- Personalized messaging

- Contact + feedback tracking

- First 10 contacts included

- Gemini-level AI chat support

- Continuous investor recommendations

- Contact CMS (scouting → outreach → feedback → iteration)

- Meeting & feedback insights

- Notifications & next-step prompts

advisors: Get Matched With Live Founder Mandates

“Join the Iceberg advisor network and get introduced to founders who are actively raising and already set up with investor context, outreach, and momentum.”

Share your sector focus, deal size, and availability, and we’ll match you to relevant mandates where your experience and network can have immediate impact.

- Run multiple live mandages in one system

- Investor lists prepared and kept current

- Structured outreach and comms workflows

- Visibility across investor engagement

- AI-assisted investor relations and follow-up

- Admin support for inbox and interaction tracking

- Ongoing deal flow where there is strong fit

Don’t just take our word for it

An end-to-end AI-Fundraising Assistant

In collaboration with hundreds of community-centric founders, we have developed an end-to-end scalable system to enable trust and rapport building with potential supporters.

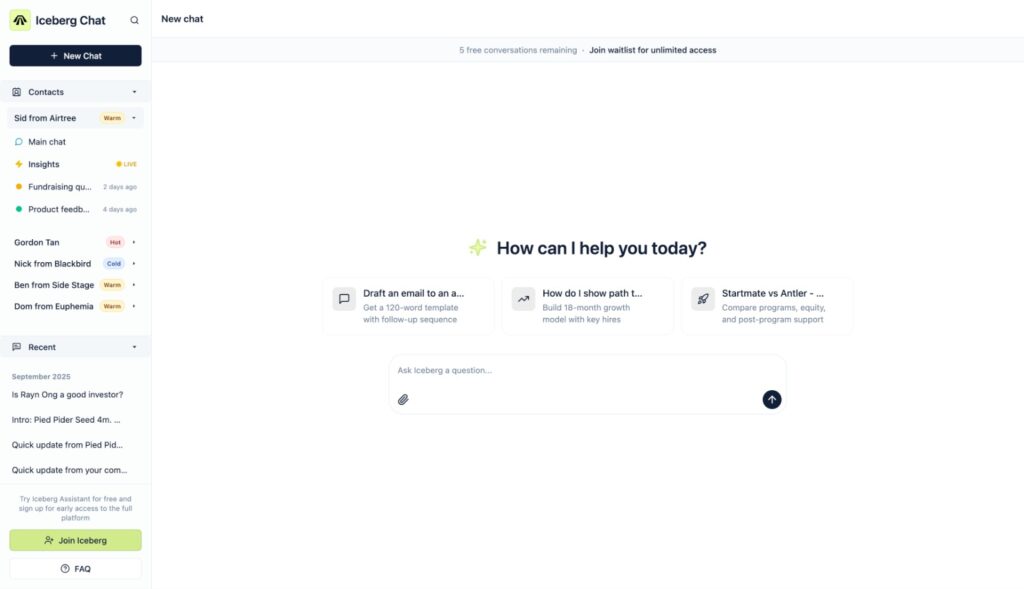

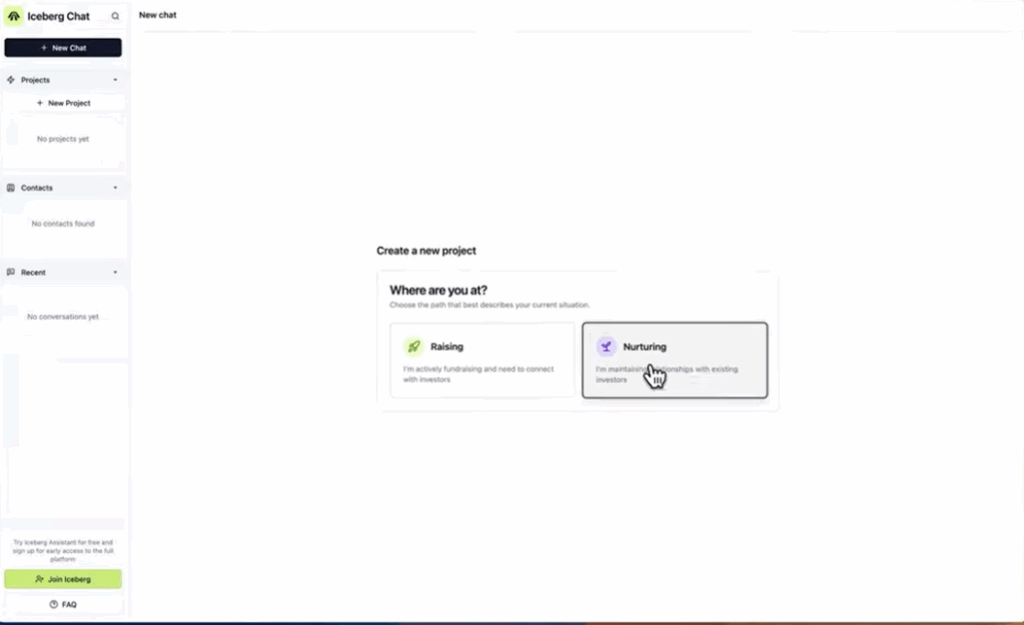

A 24/7 AI-Fundraising Assistant

You can ask and prompt our Assistant with any investor or fundraising-related questions

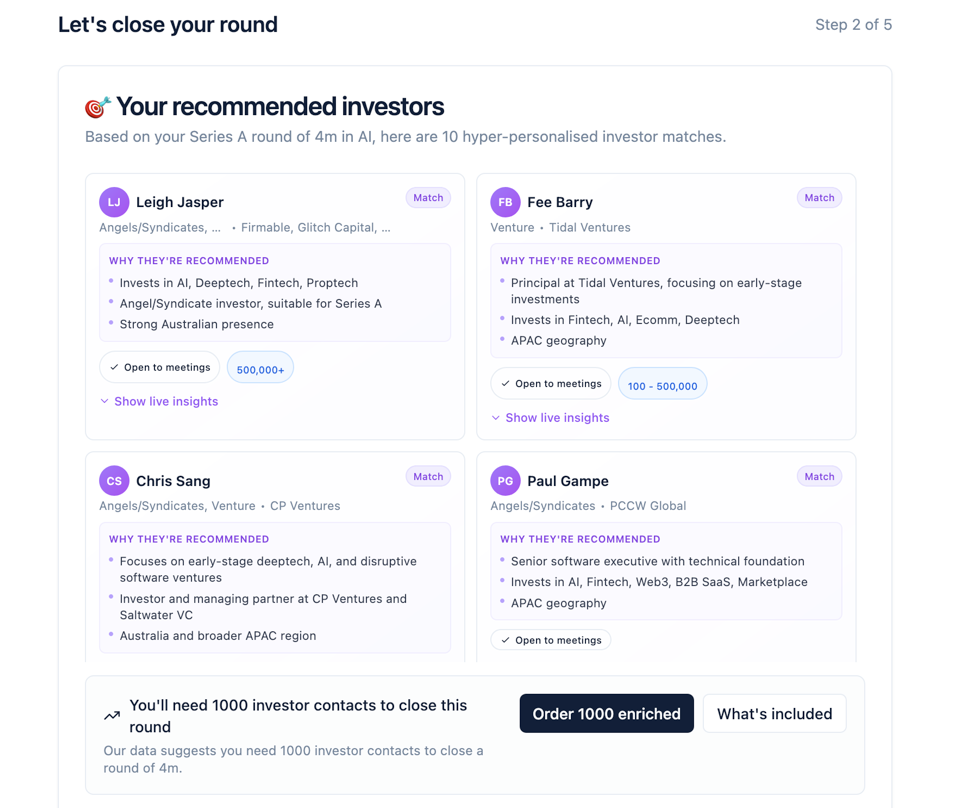

Build your perfect Investor list

Iceberg will proactively build your perfect capital network for you based on your needs

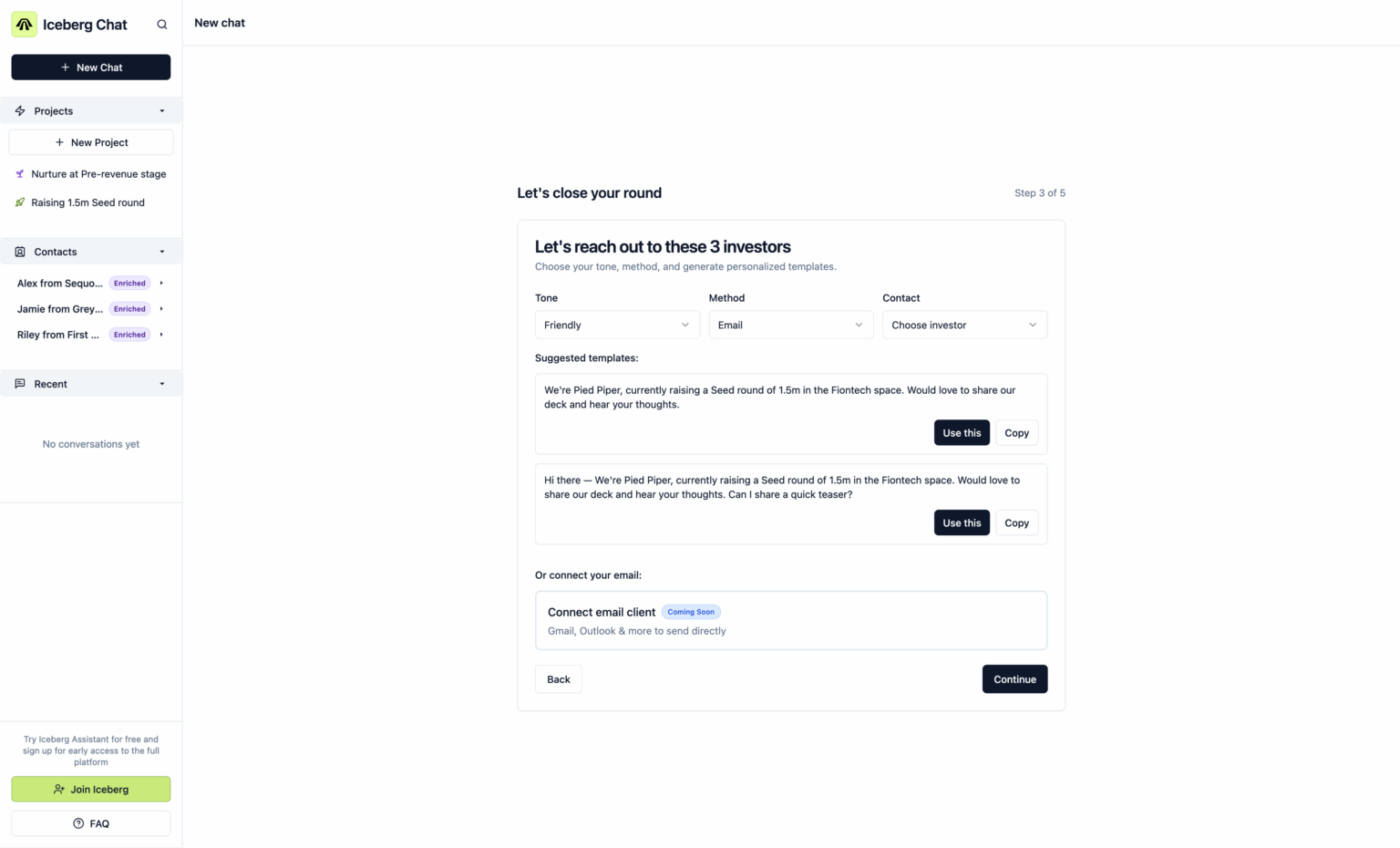

Your communication on autopilot

We’ll draft and schedule outreach and responses to all your new investor relationships

Build your network on your own accord with multiple live workspaces

So you can sit back and use our network health reporting to take the next best steps

Don’t sweat the small stuff

Then direct Iceberg to help execute your admin

Customer success stories

We love to work with founders and advisors who:

Need some more info? Book a time to chat with our team

Have a deck/madate ready for review or distribution

Are ready to have investor conversations

Want to land capital within the next 3 months

How does this differ from utilising chatGPT or alternate AI platforms?

A Compounding Data Moat: Every interaction from every founder makes the Assistant smarter for all users—a network effect that individual tools cannot replicate.

The real value of utilising the Iceberg Assistant and proprietary database is how it’s trained to identify the intricacies of communicating with specific investors upon initial outreach and ongoing nurturing.

Founders can forget using spreadsheets, email, chat LLMs, LinkedIn, and online databases to manage their fundraising – they can now use Iceberg instead..

What's the difference between your investors lists and what is already available online?

Our lists have been developed with all of the founders we have worked with so far. Meaning all of the investors that we recommend our live active investors and have already proven to respond. Our enrichment not only includes basic contact details, our live insights also surface relevant and recent market data and because so many founders use our system as their daily investor engagement tool we can also surface important contextual insights and sentiment change such as how a particular investor is thinking about certain sectors.

Couldn't I just get communication templates anywhere?

Our templates have been developed and are still developing continuously as various founders try different tones, positioning and layers of personalisation to get cut through on original outreach and nurturing with investors. We’ve been tracking and analysing the various communications used and profiling them against many different variables of investors. This way we are able to constantly iterate and offer the best current performing template for that investor profile at that particular time.

How do you ensure contacts aren't all just getting the same messages?

We have a hot and cold slider depending on how many times one contact has been contacted by founders we work within our global database and the context of your actual business.

Assistant inclusions

- A set amount of contacts

- CMS system

- Individual investor insights

- AI-Fundraising assistant chat

- Recommended Investor templates

- Reminder notifications

How do I figure out who the right Investor is for me?

At Iceberg, we’ve been building investor lists for years and matching them with founders. Depending on what stage, industry, geography, and what type of growth you are projecting, and your personal or business strategic needs, will influence who the right investors are. With our assistant, we’ll give you 10 initial contacts so you can give feedback to refine before committing to a larger list to set you up for your whole raise.

How do I know if investors are currently investing?

We only recommend investors who have been recently active across the Iceberg platform.

Can you get different types of investors and investors from overseas?

Yep – we can get you investors from wherever you’d like.